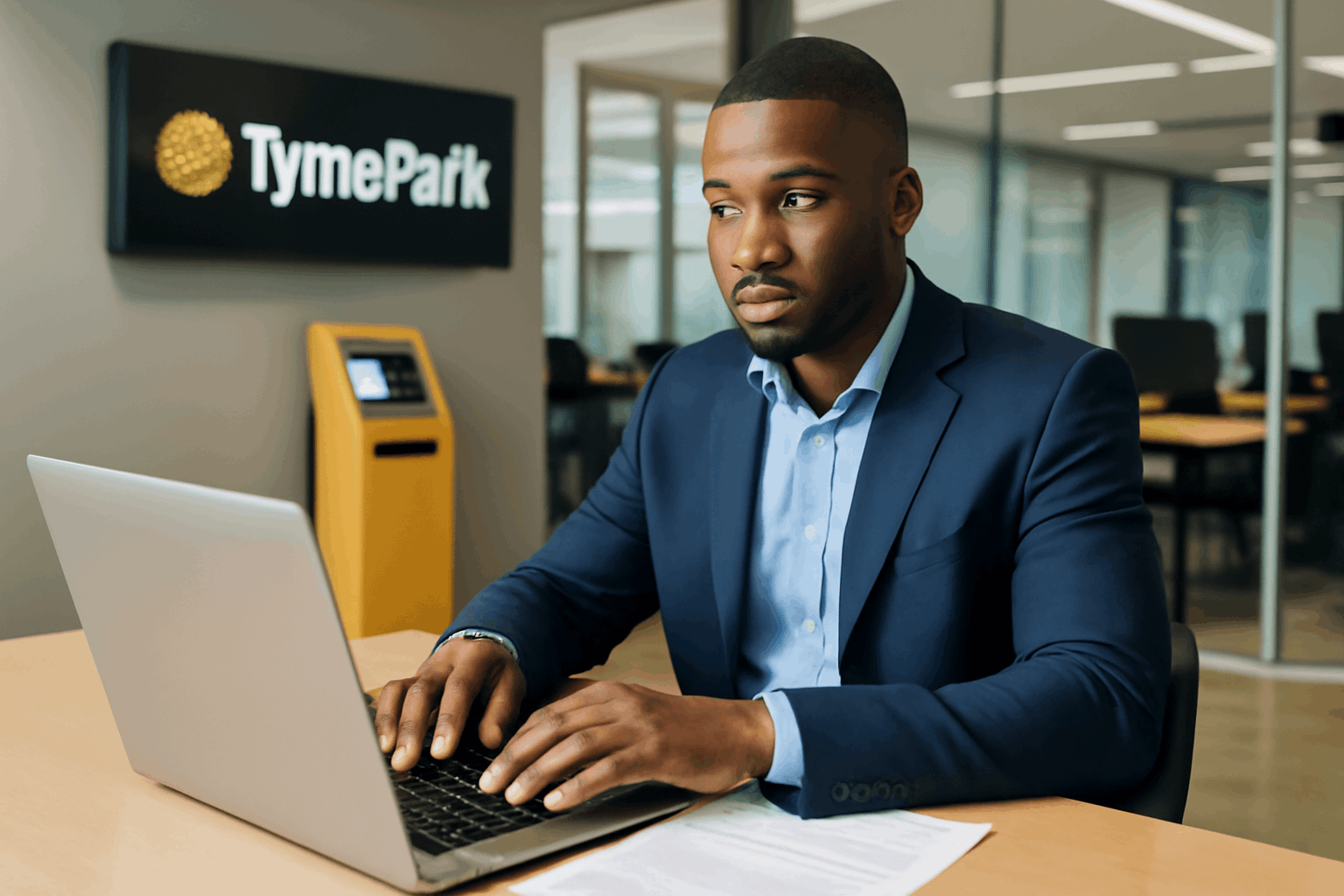

If you are considering a TymeBank job application in South Africa, the following guide will walk you through how to apply.

TymeBank is a digital-only bank in South Africa that emphasises simplicity, transparency, and affordability.

Since its launch in 2019, TymeBank has grown rapidly and regularly posts job openings across different areas.

Step 1 — Understand What TymeBank Is and What They Value

TymeBank is a fully digital bank. It avoids traditional branches and instead works via an app, internet banking, and self-service kiosks located in retail chains.

Their mission emphasises simplicity, transparency, and affordability, providing accessible banking options for many South Africans.

Many of the bank’s staff positions involve customer-facing roles in kiosks or call centres, as well as roles in technology, data, and operations.

Understanding TymeBank’s ethos and business model helps candidates tailor their applications to match the company’s values.

Step 2 — Identify Open Job Opportunities

To find open positions at TymeBank, the first stop should be the Careers page on the official TymeBank website.

On this page, you will see a list of available roles across different departments.

Common jobs include: sales consultant, brand ambassador, call centre agent, software engineer, data roles, and other customer-service positions.

Vacancies at the time of application may vary depending on demand and the bank’s needs.

Step 3 — Prepare Your Application Materials

A current CV with relevant education or work experience. Roles in tech or data may require a degree or qualification in IT, data science, or finance.

A cover letter (if requested) that explains your interest in the role and why you believe you fit TymeBank’s mission and values.

Any additional documents requested in the job posting (for example, proof of qualifications or certificates).

During the preparation phase, review the job description carefully to ensure you understand the requirements.

Step 4 — Submit Your Application Through the Official Portal

Visit the TymeBank careers page and select the job opening you are interested in.

Create a profile (if required), upload your CV and any supporting documents, and complete any application questions.

Some portals may ask for cover letters or other information. Submit your application before the closing date specified in the listing (if applicable).

Candidates are encouraged to apply only through the official portal to avoid scams or false postings.

Step 5 — Interview Process: What to Expect

Applicants who pass the initial screening may receive an interview invitation.

This can happen via a phone call, video call, or sometimes a walk-in, depending on the role.

Common topics in interviews at TymeBank include:

- Background and work experience, especially in customer service or retail environments.

- Personal strengths and weaknesses.

- Understanding of banking sector basics and TymeBank’s mission (simplicity, financial inclusion, transparency).

- For tech or operations roles, knowledge relevant to the role (for example, Agile/Scrum for developers) may be part of the interview.

Most applicants describe the interview as straightforward, with an atmosphere described as “relaxed” by some former employees.

If selected, the bank may contact you within a short time, but this can vary depending on the role and demand.

Step 6 — What to Know About Pay

Entry-level positions, such as Brand Ambassador, reportedly earn around ZAR 4,658 per month based on some anonymous reports.

Other sources suggest entry-level or lower-level roles may range from ZAR 10,000 to ZAR 15,000 per month.

For more skilled roles such as software engineering (entry level), digital-native salaries for South Africa are around ZAR 33,618 per month.

More advanced positions, such as mid-level data or analyst roles, may pay significantly higher, with a wide pay spectrum depending on seniority.

Working Conditions

Some employees report limited additional benefits, such as a pension or other standard benefits common in traditional banks.

Reviews from staff (particularly customer-facing roles) often cite high targets, long hours or pressure to meet sales or account-opening quotas.

Because of this, some applicants find TymeBank suitable for first-time jobs, albeit with possible stress due to target-driven environments.

Step 7 — After the Offer: What to Expect

You may be onboarded into a kiosk-based, retail, call-centre, tech, or admin role, depending on what you applied for.

For retail/kiosk roles, expect to work under target-driven conditions, often with sales or account-opening quotas.

For technical or data roles, expect tasks aligned with digital banking infrastructure, software development or data analysis (depending on role).

You may have access to incentives or bonuses if you meet or exceed targets (though this varies by role).

Tips to Improve Your TymeBank Job Application in South Africa

Highlight TymeBank’s values: customer service, digital literacy, flexibility, sales or retail experience, and interest in financial inclusion.

Be ready for questions about your background, strengths, weaknesses, and why you want to work at a “digital bank” rather than a traditional one.

If applying for kiosk/retail roles, be prepared for target-driven work, possible long hours, and working under pressure.

For technical/data roles, ensure you have relevant skills (software, data handling or analytics), but know that pay may still be more modest.

Competitors

Here is a comparison table showing TymeBank and several other South African banks that can serve as alternative employers.

| Bank / Employer | Scale / Reach (customers or employees) | Work Environment & Reported Conditions* | Typical / Reported Pay & Benefits* |

|---|---|---|---|

| TymeBank | Rapid growth since launch 2019; among the fastest‑growing digital banks in SA. | Many roles are customer-facing at kiosks or call centres; other roles in tech / operations. Some reports highlight target-driven sales or account‑opening quotas for kiosk staff. | Entry‑level / “brand ambassador” / junior roles reportedly on the lower end of pay scale. Some sources point to limited benefits compared to traditional banks. (Exact typical salary data for TymeBank employees remains sparse and variable.) |

| Capitec Bank | As of 2025, serves ~24.1 million customers across South Africa — the largest customer base among major retail banks. | Mixed reviews: employees note exposure to “interesting projects” and opportunities to learn; many emphasise heavy workload, long hours, strict targets, and sometimes limited work‑life balance. | According to public pay‑review data, average base pay translates to around R371,000 per year (≈ R26,000/month), though this varies widely by role and seniority. |

| Discovery Bank | Smaller customer base compared with big retail banks — around 1.2 million customers as of 2025. | As a newer digital bank, may offer roles in tech, support and operations; working conditions and corporate culture details are less widely published compared to larger banks. | Public data on typical pay for employees at Discovery Bank is limited; because it’s a smaller employer, pay and benefit data are not broadly shared or benchmarked. |

Conclusion

A TymeBank job application in South Africa encompasses opportunities across retail banking, customer service, technology, and administrative roles.

Its digital-only model and mission of financial inclusion make it an interesting option for job seekers in South Africa.

If you follow the steps described, you can increase your chances of getting hired.