The Mitsubishi UFJ Nikos VIASO Card provides a convenient way to earn cash back automatically on your everyday purchases.

With no annual fee, and provided it’s used at least once a year, it’s a practical option for residents in Japan.

This guide explains the key benefits, interest rates, and how you can apply online easily.

What is the VIASO Card?

Mitsubishi UFJ NICOS, part of the MUFG Group, issues the VIASO Card. It’s available as a Visa or MasterCard.

This card is designed for everyday spending, including online shopping ETC toll payments.

Who Can Apply?

To obtain your VIASO Card, you must meet a few basic eligibility requirements.

- You must be 18 years or older and a resident of Japan.

- You cannot be a high school student.

- You must have a stable income (employed or self-employed), or be dependent on someone with a steady income.

Key Benefits of the VIASO Card

The VIASO Card offers several practical benefits that make it ideal for daily spending and digital users.

Here’s what you get when you use this card:

- Automatic cashback is credited once a year, with up to 3% earned on mobile, internet, ETC payments.

- No annual fee if you use the card at least once a year.

- Compatible with Apple Pay, Google Pay, and QUICPay for easy mobile use.

- Includes overseas travel accident insurance up to ¥2 million.

- Offers purchase protection up to ¥100,000 for 90 days after eligible purchases.

- Extra points available through VIASO e-Shop partner websites.

Interest Rates and Fees

Here are the interest rates and fees you should know when using this card:

- Annual Percentage Rate (APR): 15.99% to 24.99% for purchases, balance transfers, and cash advances, depending on your credit score

- Annual fee: ¥0

- Cash advance fee: Either ¥1,000 or 5% of the withdrawn amount—whichever is higher

- Late payment fee: Up to ¥4,000 per missed payment

- Over-limit fee: Up to ¥4,000 if you exceed your credit limit

- Foreign currency conversion fee: 3.85% (including tax) on overseas or foreign currency transactions

How to Apply for the VIASO Card

You can apply for the VIASO Card in just a few steps using the official website. Here’s what to do:

- Official Website Access – Visit the VIASO Card page to start your online application.

- Form Submission – Enter your full name, address, phone number, income details, and employment info.

- Identity Verification – Please upload documents such as your Residence Card or MyNumber Card for screening.

- Application Review – Wait 1–3 business days for a decision after submitting your information.

- Card Delivery – Once approved, your VIASO Card will arrive by mail within 1–2 weeks.

Basic Requirements

These are the basic requirements you need to meet before applying for this card:

- Age & Residency: Must be 18 or older and a resident of Japan.

- No High School Students: Applicants who are currently in high school aren’t eligible.

- Stable Income: Either employed or self-employed with a steady income or a dependent family member with financial support.

- Japanese Bank Account: Required for billing and receiving cashback.

- Mobile Phone Number: Required for online verification and communication purposes.

VIASO e-Shop and Extra Point Offers

The VIASO e-Shop is an online portal that gives you bonus points when you shop through partner stores.

It’s an easy way to maximize your cashback without extra effort.

- Bonus Points on Purchases – Earn up to 10× more points by shopping through partner retailers like Amazon, Rakuten, and Yahoo! Shopping.

- Simple Access – Log in to the VIASO e-Shop and click through to the store you want to shop at.

- Regular Promotions – Look out for seasonal campaigns offering limited-time point boosts.

- Wide Store Selection – Over 400 participating online shops are available across different categories.

- Automatic Tracking – Points are automatically credited when you use the e-shop link before making a purchase.

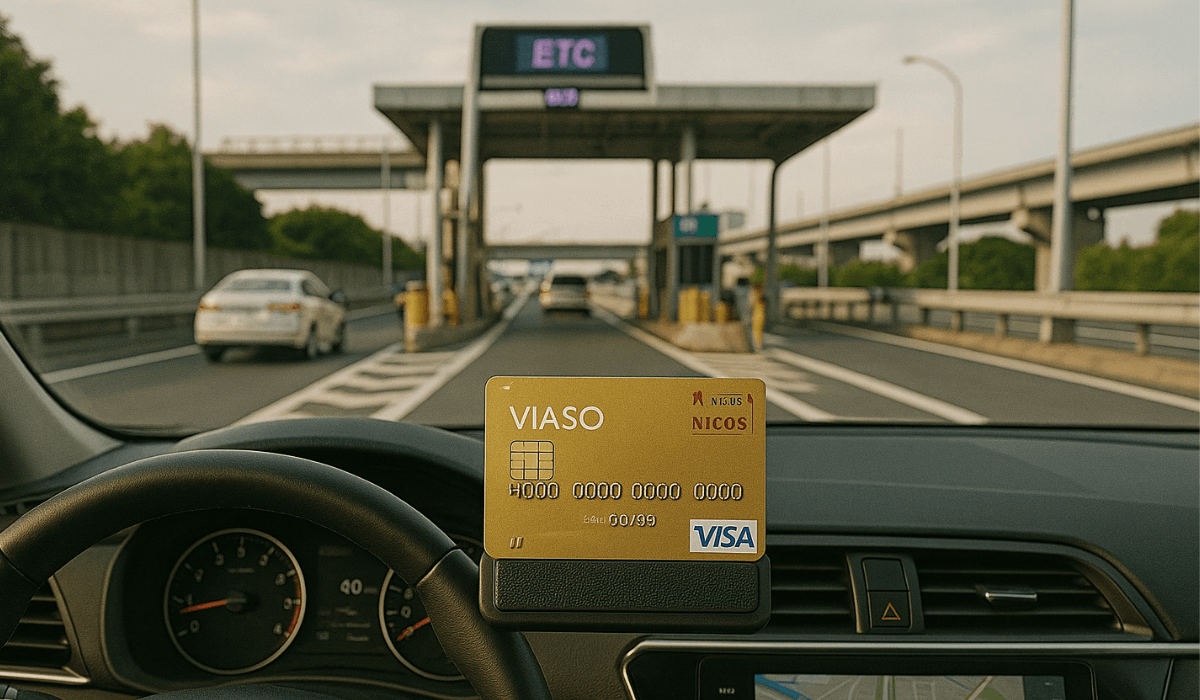

Using the VIASO Card for ETC Payments

Using the VIASO Card, along with an optional ETC card, makes highway toll payments smoother and more rewarding. Here’s how you benefit:

- ETC Card Linkage – Apply for an optional ETC card that’s directly linked to your VIASO account.

- Extra Cashback – Earn up to 3% cashback on toll payments made via ETC.

- No ETC Annual Fee with Use – The ¥1,100 annual fee is waived if the card is used at least once a year.

- Automated Billing – Toll payments are charged monthly to your VIASO Card, eliminating the need for cash.

- Ideal for Frequent Drivers – Especially useful for commuters and those who regularly travel through toll roads.

Managing Your VIASO Card Online

You can easily manage your card online via the Mitsubishi UFJ NICOS website or mobile app.

These tools give you control over payments, points, and card settings at any time.

- Account Dashboard – View your current balance, transactions, and monthly statements at a glance.

- Points Tracking – Check earned and bonus points, including e-Shop activity and cashback status.

- Payment Options – Make additional or early payments and set up automatic payments from your bank.

- Notification Settings – Enable alerts for purchases, payment due dates, and account activity.

- Card Controls – Temporarily block your card or report issues directly through the app.

- Document Access – Easily download digital copies of billing statements for your records.

Pros and Cons Summary

Before applying, it’s helpful to weigh the advantages and limitations of the VIASO Card. Here’s a quick breakdown to help you decide:

Pros:

- No annual fee if used at least once per year.

- Automatic cashback without manual redemption.

- Extra points through VIASO e-Shop partners.

- Mobile payment compatibility with Apple Pay, Google Pay, and QUICPay.

- Travel and purchase insurance are included at no extra cost.

Cons:

- Cashback is only credited once a year.

- Points expire after 12 months if unused.

- Application and support are available in Japanese only.

- No flexibility in choosing monthly cashback or other point uses.

Contact Information

Need help with your VIASO Card? You can reach customer support through several convenient options:

- NICOS Call Center: 0570‑025‑405 (or 03‑5940‑1100) — available daily 9:00 AM–5:00 PM.

- Etc Plus Card Hotline: 0120‑254‑824 — 24‑hour automated service for ETC-related inquiries.

- Card Loss/Theft (Japan): 0120‑159‑674 — 24‑hour support to report and block your card.

- Card Loss/Theft (Overseas): +81‑3‑3514‑4091 — available 24 hours for international cases.

- VIASO Insurance Desk: 0120‑342‑511 — available daily 9:00 AM–5:00 PM for travel insurance questions.

- MUFG Card Enrollment Support: 0120‑151‑117 — for issues related to online registration and e-statements.

To Wrap Up

The VIASO Card is a strong entry-level option for those who want automatic cashback and no annual fee.

Its appeal grows if you regularly pay for ETC tolls, internet, or mobile services.

If you meet the criteria, applying online is fast and simple—take advantage today.

Disclaimer

The information provided in this article is for general guidance only and may be subject to change by Mitsubishi UFJ NICOS.

Always refer to the official VIASO Card website or contact customer service for the most accurate and updated details.