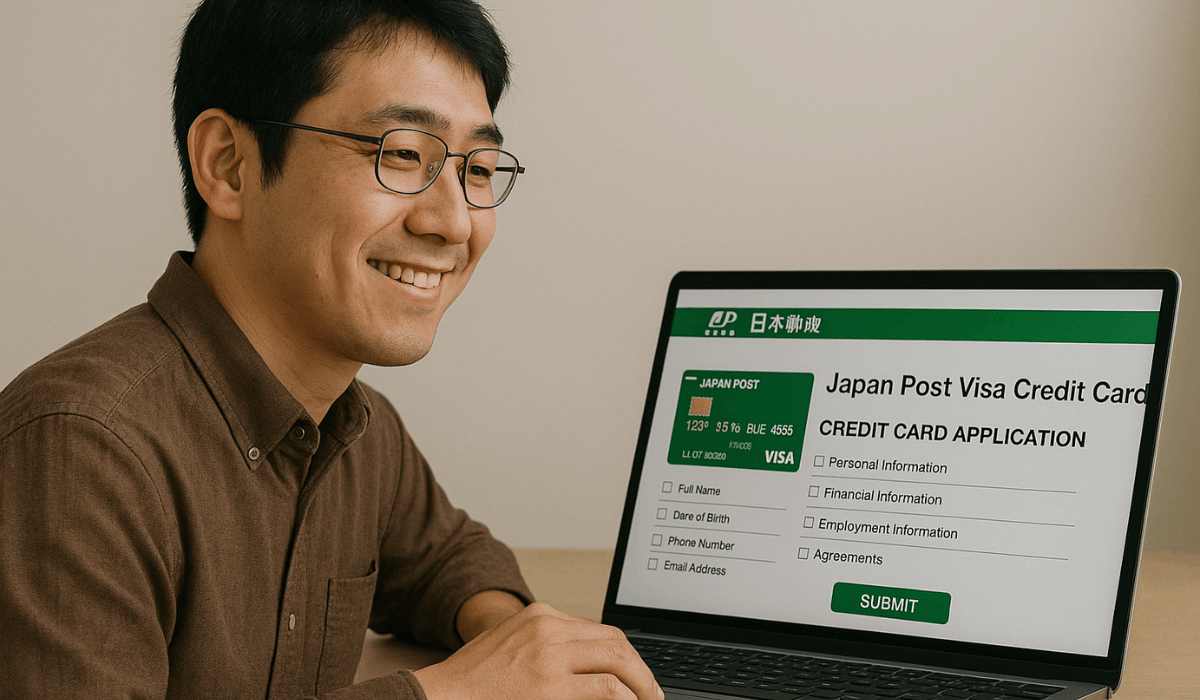

Applying for the Japan Post Visa Credit Card online is a simple process with benefits for everyday purchases and travel.

In this guide, we will walk you through the simple steps to apply, including eligibility requirements, interest rates, and associated fees.

Whether you’re new to credit cards or looking to switch, this guide will equip you with all the information you need to get started.

Key Features of the Japan Post Visa Credit Card

The card offers a wide range of features designed to enhance both convenience and security for cardholders significantly.

Below are the key benefits that make this card an excellent choice:

- Global Acceptance: Accepted worldwide at millions of locations for both domestic and international transactions.

- Reward Points Program: Earn 1 point for every ¥1,000 spent, redeemable for various rewards.

- Mobile Wallet Compatibility: Works with Apple Pay and other mobile payment systems for easy transactions.

- Enhanced Security: Equipped with EMV chip technology and purchase protection for secure payments.

- Exclusive Offers: Access special promotions and discounts at various merchants.

- Integration with Japan Post Banking: Manage your card easily through Japan Post Bank’s online and mobile platforms.

- ATM Cash Withdrawals: Withdraw cash at Japan Post Bank and affiliated ATMs across Japan.

Eligibility Requirements

To apply for the Japan Post Visa Credit Card, you must meet the following criteria:

- Age: Be at least 16 years old.

- Residency: Be a resident of Japan.

- Residence Card: Possess a valid residence card.

- Email Address: Have an active email address.

- Income: Demonstrate a stable income.

- Credit History: Maintain a good credit history.

- Application Process: Complete the application via the official Japan Post Bank website or app.

Applicants under 16 years of age or without a residence permit are ineligible. If your residence card expires within three months, you may also be ineligible to apply.

Ensure your card is valid for a sufficient period before applying.

How to Apply Online

Applying for the Japan Post Visa Credit Card online is a straightforward process.

Follow these steps to complete your application:

- Visit the Official Website: Go to the Japan Post Bank credit card application page.

- Select Your Card Type and Brand: Choose your card type (e.g., ALente, EXTAGE, Gold) and preferred brand (Visa, Mastercard, or JCB).

- Agree to Terms and Conditions: Read and accept the membership terms and conditions.

- Register Your Email Address: Enter your email address to receive a one-time password for verification.

- Enter the One-Time Password: Check your email for the one-time password and enter it on the application page.

- Provide Personal Information: Fill in your details, including your name, date of birth, address, and employment information.

- Submit Your Application: Review all entered information for accuracy and submit your application.

- Await Approval: Japan Post Bank will review your application. If approved, your credit card will be mailed to the address you have registered.

Interest Rates and Fees

Understanding the interest rates and fees associated with this card is crucial for effective financial management.

Here’s a breakdown of the key charges:

- Annual Fee: ¥1,375 (tax included), waived for the first year. One purchase in the previous year waives the fee for the following year.

- Interest Rate on Purchases: Approximately 15% per annum on outstanding balances.

- Cash Advance Fee: 2% of the withdrawn amount, with a minimum charge of ¥110. Interest on cash advances is set at 18% per annum.

- Late Payment Fee: A penalty interest rate of 14.6% per annum is applied to overdue amounts.

- Foreign Transaction Fee: 1.63% of the transaction amount. This fee covers currency conversion and international processing costs.

- Card Replacement Fee: ¥1,100 (tax included) for issuing a replacement card in case of loss or damage.

- Statement Reissue Fee: ¥550 (tax included) per statement for reissuing past account statements.

Application Review and Approval

After submitting your online application, the bank will review your details, including personal information, credit history, and employment history.

Here’s what to expect:

- Application Submission: You fill out the online application form with your personal and financial details.

- Review Process: Japan Post Bank reviews your application, which includes verifying your credit history, employment, and personal information.

- Approval Notification: If approved, you will receive an email notification.

- Card Delivery: Upon approval, the credit card will be mailed to the address you have registered.

- Foreign Applicants: Foreign nationals may be required to provide identification, and the bank may contact your school or workplace for verification purposes.

Managing Your Japan Post Visa Credit Card

Managing your card effectively ensures you make the most of its features while avoiding unnecessary fees.

Here’s how to stay on top of your account:

- Monitor Transactions: Regularly check your account for updates on purchases and payments.

- Make Timely Payments: Set up reminders or auto-pay to ensure you never miss a payment.

- Track Reward Points: Keep an eye on your reward points and use them before they expire.

- Use Mobile Banking: Access your account through the Japan Post Bank app or website for easy management.

- Set Spending Limits: Adjust spending limits or request alerts for higher transactions to stay within budget.

- Review Statements: Frequently review your statements to track spending and identify any discrepancies.

- Report Issues Promptly: If you notice any unauthorized transactions, report them immediately.

Troubleshooting Common Issues

If you’re facing issues with your Japan Post Visa Credit Card, this guide will help you resolve them efficiently.

Application Rejection Without Clear Reason

- Possible Causes: Lack of stable income, recent arrival in Japan, or insufficient credit history.

- Solution: Ensure you have a stable income and a longer-term visa status. Consider applying after establishing a financial history in Japan.

Card Not Accepted at Certain Merchants

- Possible Causes: The Merchant’s terminal may not support your card’s network or may require 3D Secure authentication.

- Solution: Verify if the merchant accepts Visa cards and supports 3D Secure. If issues persist, contact customer support for assistance.

Card Not Working at ATMs

- Possible Causes: Magnetic strip damage or card lock due to multiple incorrect PIN attempts.

- Solution: Visit a Japan Post Bank ATM to reactivate your card or reset your PIN via the Yucho Tetsuzuki App.

Issues with Mobile Wallet Integration

- Possible Causes: Device compatibility or security settings.

- Solution: Ensure your device supports NFC and meets security standards. Follow the bank’s guidelines for adding your card to mobile wallets.

Problems with Online Transactions

- Possible Causes: The merchant’s website may not support CVV input, or there may be issues with 3D Secure.

- Solution: Check if the merchant’s website supports your card’s security features, or contact support if problems persist.

Contact Information

If you need assistance with your Japan Post Visa Credit Card, here are the primary contact details:

Phone Numbers:

- Within Japan (Toll-Free): 0120-108-420

- International Calls: +81-50-3850-7788

Note: Calls from overseas are chargeable and handled in Japanese.

Email:

General Inquiries: Use the online inquiry form

Note: Direct email addresses are not publicly provided; the online form is the recommended method for communication.

Mailing Address:

- Japan Post Bank Co., Ltd., 2-3-1 Otemachi, Chiyoda-ku, Tokyo 100-8793, Japan, for general correspondence and official documents.

To Wrap Up

Applying for the Japan Post Visa Credit Card online is a straightforward process.

Ensure you meet all eligibility requirements and provide accurate information.

Enjoy the benefits of a globally recognized credit card with convenient online management.

Disclaimer

The information provided is for general informational purposes only and is subject to change without notice.

Please verify all details directly with Japan Post Bank before making any financial decisions.