The Amazon Mastercard Card offers exclusive rewards for frequent Amazon shoppers.

It offers practical benefits such as cashback, no annual fee (in most cases), and seamless integration with your Amazon account.

In this guide, you’ll learn about its main features, eligibility requirements, current interest rates, and the application process.

Key Benefits of the Amazon Mastercard Card

If you shop on Amazon regularly, this card is designed to help you save more and earn rewards faster.

Below are the main benefits that make the Amazon Mastercard a practical choice for everyday spending:

- Cashback or Points on Amazon Purchases: Earn up to 3% back or points on eligible purchases made directly on Amazon.

- Extra Rewards for Prime Members: Prime members often receive higher cashback rates or bonus points.

- No Annual Fee (Standard Version): The basic version of the card typically has no yearly fee.

- Accepted Worldwide (Mastercard Network): Use it for both Amazon and non-Amazon purchases wherever Mastercard is accepted.

- Automatic Point Redemption: Redeem earned points directly at checkout with no manual steps.

- Special Discounts and Promotions: Access to exclusive Amazon cardholder deals and limited-time offers.

- Fraud Protection and Security Features: Real-time monitoring and zero liability for unauthorized charges.

- Mobile and Online Access: Manage your card, check rewards, and pay bills through Amazon or the issuer’s app.

Eligibility Requirements

Before applying, it’s essential to ensure you meet the basic qualifications.

These requirements help determine whether you’re likely to be approved and ensure your application is processed smoothly.

- Minimum Age Requirement: You must be at least 18 years old (or the legal age in your region).

- Valid Government ID: A government-issued ID is required to confirm your identity.

- Stable Source of Income: You should have a regular income or employment to demonstrate repayment ability.

- Good Credit History: A fair to good credit score is generally expected; approval depends on your financial profile.

- Active Amazon Account: You need a registered Amazon account in the country where you’re applying.

- Residency Status: Applicants must be legal residents of the country where the card is issued.

Interest Rates and Fees

Knowing your card’s rates and fees helps you manage spending. Here’s a quick look at the common charges:

- Annual Fee: ¥0 for the Classic version (waived with one yearly purchase). The Gold version costs ¥11,000 annually and includes Amazon Prime.

- Purchase Interest Rate (APR): Standard purchase APR is approximately 15.0% to 18.0%, depending on your creditworthiness.

- Cash Advance Fee: Typically around 3% to 5% of the amount advanced, with a minimum fee of ¥300.

- Late Payment Fee: Up to ¥3,000 if payment is not made by the due date.

- Foreign Transaction Fee: None. You won’t incur additional charges for purchases made outside Japan.

- Minimum Interest Charge: If interest is charged, the minimum amount is ¥100.

How to Apply

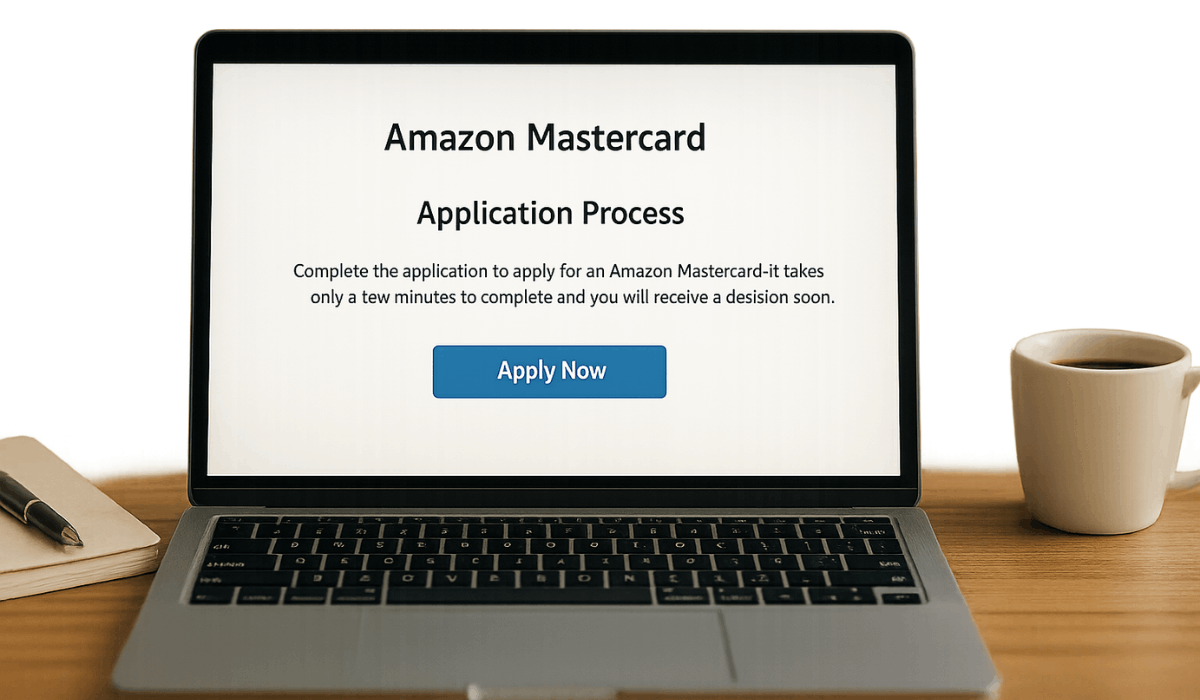

Applying for the Amazon Mastercard in Japan is a straightforward process that can be completed online.

Whether you’re a Prime member or not, you can follow these steps to apply for the card:

- Sign in to Your Amazon.co.jp Account: Visit Amazon.co.jp and log in to your account.

- Navigate to the Amazon Mastercard Application Page: Go to the Amazon Mastercard application page and click on the “Apply Now” button.

- Fill Out the Application Form: Enter your name, address, birth date, job, and income. Make sure everything is accurate.

- Select Card Type and Additional Options: Choose Classic or Gold, and optionally add ETC or family cards.

- Review and Submit Your Application: Double-check all the information you have entered and submit your application.

- Await Approval and Card Delivery: Approval is instant or takes a few days. The card will arrive within one week after approval.

- Activate Your Card: After receiving your card, follow the instructions provided to activate it. You can then start using it for your purchases.

Managing Your Card Online

Once your card is active, managing it online makes tracking spending and handling payments easier.

You can access key features at any time through your account dashboard or mobile app.

- View Transactions: Check your recent purchases and transaction history in real-time.

- Monitor Rewards: Track your earned points or cashback directly from your account.

- Make Payments: Pay your balance manually or set up automatic payments.

- Download Statements: Access and download monthly billing statements for your records.

- Set Alerts: Enable notifications for payment due dates, spending limits, or suspicious activity.

- Update Information: Edit your contact details, billing address, or linked bank account.

- Access via App: Use the card issuer’s app for mobile access to all features.

Security and Fraud Protection

Keeping your card and personal data safe is a top priority.

The Amazon Mastercard features several built-in security measures to help you prevent fraud and stay protected during both online and in-store transactions.

- Real-Time Fraud Monitoring: Your account is continuously monitored for suspicious or unusual activity.

- Zero Liability Policy: You’re not held responsible for unauthorized charges if reported promptly.

- Transaction Alerts: Get instant notifications via email or app for every purchase.

- Two-Factor Authentication: Secure logins with an added verification step to protect your account.

- Card Lock Feature: Temporarily disable your card through the app or dashboard if it’s lost or stolen.

- Emergency Card Replacement: Quick assistance and card reissue in case of theft or loss.

Comparing Amazon Mastercard to Other Cards

Picking the right card depends on your spending habits. Here’s how this card compares to other common options.

- Store-Specific Cards: The Amazon Mastercard works anywhere, unlike store cards that are limited to Amazon.

- Cashback Cards: They offer better rewards on Amazon, but others provide flat-rate cashback on all purchases.

- Travel Cards: Lacks travel perks, such as lounge access or insurance, typically found in premium travel cards.

- Prime Membership Cards: The Gold version includes Prime, adding value for frequent Amazon users.

- No-Fee Cards: The Classic version competes with no-annual-fee cards and offers Amazon-focused rewards.

Contact Information

If you have questions, need support, or want to manage issues related to your card, here’s how to reach the proper service channels.

This contact info is specific to users in Japan.

- Customer Support (General): 0570-004-980 (Japanese only)

- International Calls: +81-3-6627-4127

- Business Hours: 9:00 AM – 5:00 PM JST, Monday to Friday (excluding holidays)

- Lost or Stolen Card: 0120-919-456 (24/7, toll-free)

The Bottomline

The Amazon Mastercard offers practical rewards, a no-annual-fee option on the basic version, and seamless integration with your Amazon account.

It’s a solid option for frequent shoppers looking to save more with each purchase.

If you’re eligible, apply online today and start receiving benefits immediately.

Disclaimer

Interest rates, fees, and rewards may vary depending on your credit profile and the card version you choose.

Always review the latest terms and conditions provided by the issuing bank before applying for the loan.